VC and PE Investment Seasonality

Helpful Hints For Financing Your Startup or Established Company based on the Season

Startup leaders, including founders, CEOs, CFOs, and boards, must incorporate financing seasonality into their economic plans and analysis. Financing seasonality in the startup world refers to annual trends in investments from traditional and corporate VC and private equity (PE), as well as valuations.

Recognizing and addressing the seasonality of financing improves financial stability and cash flow projections, helping startups optimize resources and make informed financing decisions. It also aids in investor communication, provides a competitive edge, streamlines operations, boosts investor confidence, and attracts more favorable financing terms.

This is why experienced advisors, who have witnessed numerous seasons, are valuable, and should be leveraged by the leaders of emerging businesses.

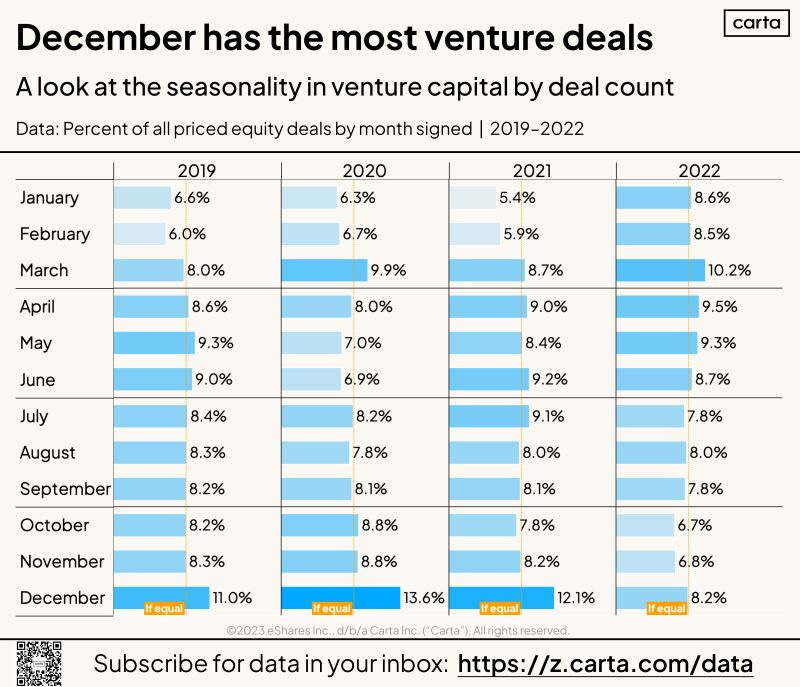

Below is a chart from Carta (data provided for each full year since 2019) that captures the ebbs and flows of seasonal financing:

It's important to note that the data provided by Carta is sourced directly from cap tables, offering accurate insights into invested capital, valuations, percentages, and round dates. Unlike data from press releases or articles in the media, this information is grounded in the real financial transactions of companies. As such, being aware of these trends is a wise practice for startup that are in the midst of fundraising and deal-making initiatives.

In this case, four years of historical data provides insights into seasonal trends, which should be adequate if the patterns are straightforward and consistent. For more complex and volatile seasonality, taking a longer view of data may be helpful in developing reliable forecasts.

A more in-depth analysis, incorporating practical insights from traditional and corporate VC and PE financing practices, reveals the following:

December is a significant month for startup deals. This may be attributed to investors looking to close deals before the new year or other factors. Some firms – such as corporate VCs (aka “strategics”) have budget allocations and therefore feel year-end pressure to invest in startups. One VC told me, “If you don’t have the due diligence and final paperwork done by December 15th, it’s not going to close and it’s a New Year’s {read: January} deal.”

January and February experience a fall-off relative to the average in:

Priced Equity Fundraising: In 2024, there may be a decline in priced equity rounds in the first two months of the year due to cautious investor sentiment at the start of the year that is influenced by forecasts of neutral GDP growth or potential recession.

Pre-seed SAFEs and Convertible Notes: Similarly, pre-seed SAFEs and convertible notes may experience lower activity levels in January and February 2024. As such startups seeking early-stage financing should be prepared for this seasonal dip.

In many cases, work-flow happens in early December and there are investors – such as PE – who start-off the new year “at full speed”.

Q2 stands out as the most dependable quarter for deals, which is often attributed to improved economic stability and investor confidence rebounding after the early months of the year. In the realm of PE, transactions, especially those involving extensive due diligence and financing complexities, often span three months or more. As a result, deals initiated in January tend to be finalized and concluded during Q2.

Q3 experiences a notable slowdown due to the summer season. Towards the end of summer, deal engagement drops significantly, mainly due to summer holidays and the reduced workdays, including Fridays at the golf course. From mid-July through August and the first week of September, activity levels typically decline.

Q4 typically brings an upswell in negotiation activity: This period often sees intense deal-making efforts as companies aim to close transactions before the year concludes.

An intriguing insight shared by a prominent investor is that well-capitalized firms have the opportunity to leverage the predictable patterns of seasonality. In competitive scenarios, when overall market activity is sluggish, an investor can adopt a more assertive approach towards particular transactions.

Startup founders, CEOs and ELT should consider seasonal effects when planning financing timelines. Despite potential disruptions, understanding the patterns described in this post can guide strategic company financing events and enhance capital efficiency, valuation growth, and strategic momentum for startups.