Introduction

After years of volatility and regulatory pressure, the IPO market rebounded in 2025. Renewed investor demand, maturing unicorns seeking liquidity, and a more favorable policy environment drive a surge in public listings. This post examines the forces behind the resurgence and highlights key companies poised to go public.

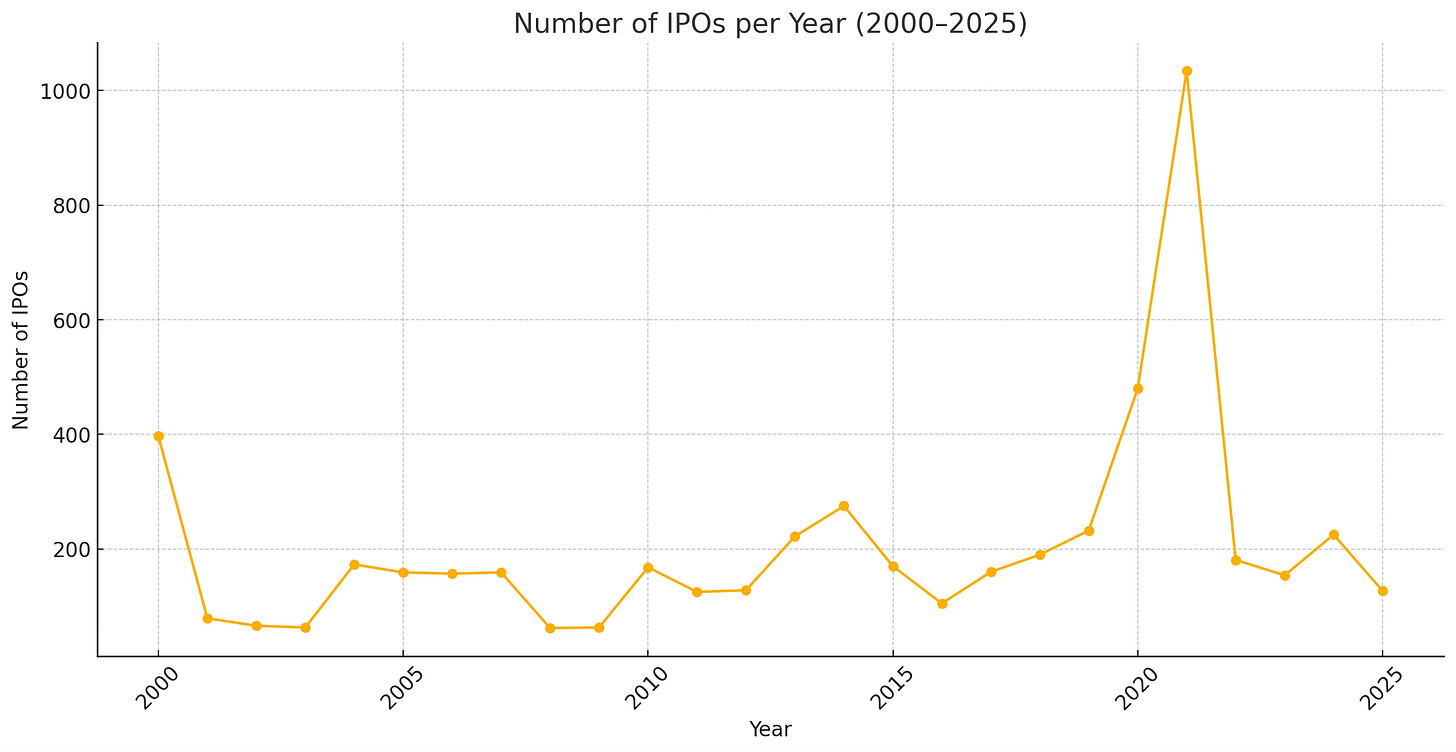

IPO Activity Over the Past 25 Years

U.S. IPO activity has experienced dramatic cycles over the past 25 years. Following a sharp decline after the dot-com crash, listings remained subdued through the early 2000s before rebounding from 2005 to 2008. The global financial crisis again slowed activity, but a strong recovery between 2010 and 2014 peaked with major offerings like Facebook, Twitter, and Alibaba. A historic boom occurred during the pandemic in 2020 and 2021, driven by low interest rates, the fiscal stimulus, and SPACs. Volatility in 2022 and 2023 curtailed listings, but 2024 marked a rebound with 225 IPOs, driven by interest in AI and biotech. As of May 17, 2025, the market continues its recovery with 127 IPOs—outpacing last year—led by high-profile debuts from Reddit and Astera Labs.

VC-Backed Companies Stay Private Longer

A growing number of companies are deliberately staying private longer for four reasons:

Venture, growth, crossover capital, and secondary markets provide both capital to founders and early investors and reduce the need for public funding.

Market volatility and high compliance costs make founders and investors prefer to maintain control, waiting for better performance or market conditions for a higher valuation.

Litigation and government regulation are burdensome and continuous distractions.

Avoiding public-market scrutiny allows operational flexibility and focus on long-term growth over quarterly reporting and short-term profitability.

Under the Biden administration, stricter regulatory scrutiny from agencies like the FTC and SEC dampened M&A and IPO activity by constraining exit opportunities. The Trump administration, by contrast, signals a more permissive—or indifferent—stance.

Strong Secondary Markets Delay IPOs

In 2025, private companies are increasingly pursuing IPOs, driven by strong investor demand and the need for liquidity among unicorns. A growing list of high-profile firms—confirmed or rumored—signals rising market confidence and a robust pipeline of public offerings. Notably, several companies in industrials, enterprise software, and healthcare—especially AI native—have been active in secondary markets, fueling speculation about upcoming IPOs. (Accredited investors can access shares via platforms like Forge Global.) These include:

Anduril, operating in the aerospace and defense subsector, is valued at $28 billion post-money following a Series G round. Not publicly traded yet, but has expressed plans to go public.

Anthropic is valued at $61.5 billion post-money from a Series E-1 round with $1.92 billion raised.

Boxabl, a modular construction company, trades at just $0.10 per share (down 37.5%) from its Series A-2, with no valuation and fundraising details.

Cerebras, a chipmaker and AI platform company, filed an S-1 registration statement with the SEC at the end of September 2024. The company’s current valuation is $7.76 billion, a 173.4% premium to its last funding round in September 2024. Has announced aspirations to IPO in 2025 but is not yet public.

Figure AI, focused on robotics, reached $194.00 per share in its Series B, with a valuation of $2.6 billion and $675 million raised.

Hinge Health is a physical therapy technology firm that uses sensors and mobile devices. The San Francisco-based company was founded in 2014 and has treated 1 million members.

MNTN, a software developer for the advertising industry, has a current valuation of $2.21 billion.

Neuralink, an AI-driven medical device and an Elon Musk company, completed a Series D round at a $3.49 billion valuation with $323.24 million raised.

OpenAI, also in enterprise software, though the valuation and round details are undisclosed.

xAI, in the enterprise software and data intelligence space, is valued at $50 billion post-money from a Series C round with $6 billion raised.

Several high-profile firms with substantial pre-public valuations—such as Stripe Inc., Chime Financial Inc., Databricks, Shein, Klarna Bank, Revolut Group, StubHub, and Zopa—have recently submitted S-1 filings, signaling renewed momentum toward public market entry amid shifting capital market dynamics.

CoreWeave (CRWV)—Nvidia-backed AI cloud platform—listed on Nasdaq in March 2025 after raising $1.5 billion. Its IPO was the largest tech debut since 2001, and the company is targeting a valuation of over $35 billion.

Conclusion

The reemergence of IPO activity in 2025 reflects a decisive inflection point in capital markets. After a period of strategic retrenchment, a growing cadre of high-growth private firms—spanning AI, defense, biotech, fintech, and infrastructure—are now repositioning toward the public markets, driven by a mix of investor appetite, liquidity needs, and favorable macroeconomic signals. This shift underscores a broader recalibration in the private-to-public capital transition, where companies that once deferred listings are now leveraging improved valuation windows and rising equity market confidence. With robust demand from institutional investors and a pipeline of well-capitalized, innovation-led firms, the current IPO resurgence may mean a structural resurgence in equity issuance.