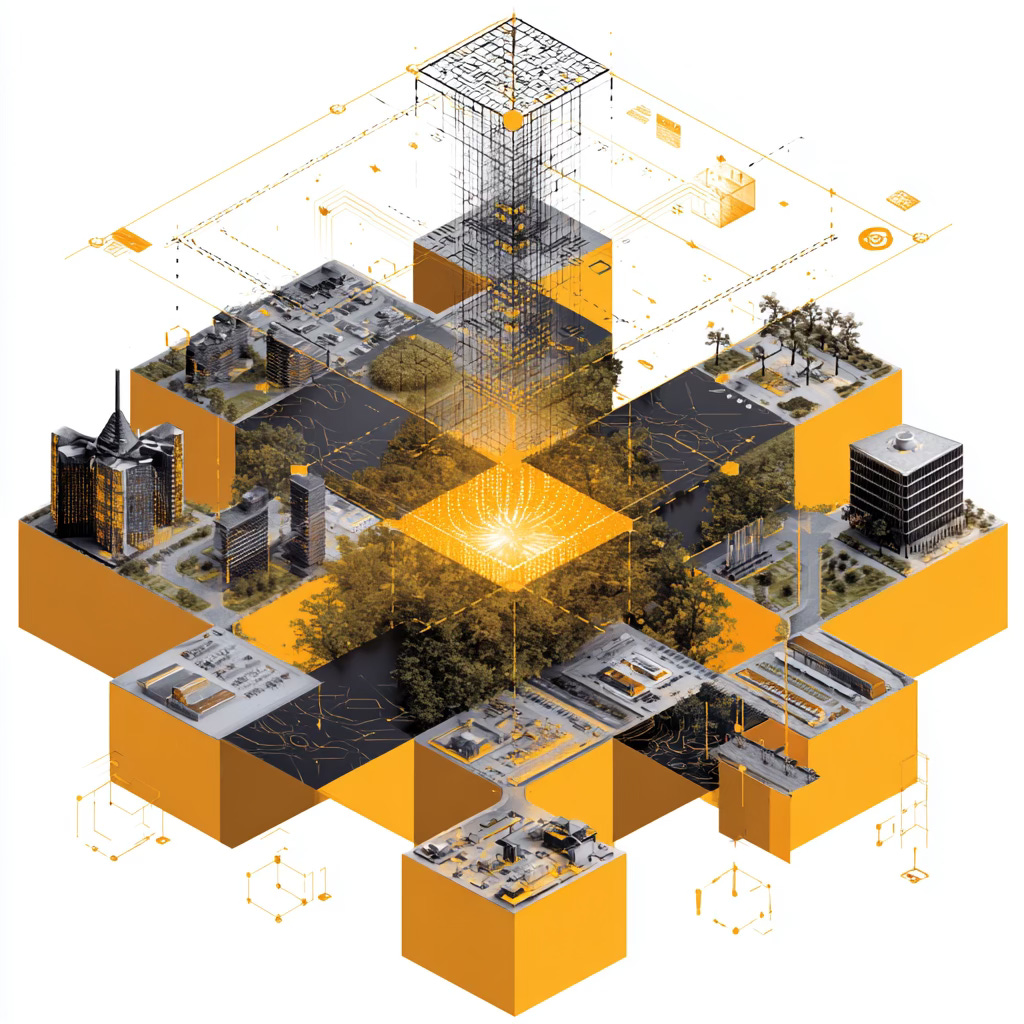

The Status of the Blockchain, 2025: From Speculation to Infrastructure

I usually publish my annual take on blockchain around Paris Blockchain Week in April pendant que je rends visite à mes amis chez Dowsers, ma société préférée de sécurité Blockchain.

The 2017 and 2021 hype waves have passed, and both the loud boosters and louder detractors have faded.

This year, the space has matured. The noise has thinned, and what remains is real infrastructure aimed at real-world use. Yet, beneath that progress, a portion of the ecosystem is still driven by speculation.

Solana, for instance, functions almost as a “Las Vegas blockchain.” The majority of on-chain activity revolves around a rapid influx of memecoins, speculative trading, and leveraged arbitrage strategies via perpetual futures. Stablecoins are the primary liquidity layer, supporting markets that are otherwise structurally illiquid.

Ethereum, as another example, remains the leading smart-contract platform, supported by a deep developer ecosystem, growing institutional adoption, and its central role in stablecoins and DeFi. Continued upgrades signal ongoing innovation, but complexity, faster competitors, and governance/contract dependencies pose meaningful execution and security risks.

But the story of where blockchain stands today is more nuanced than “up” or “down.” The landscape is uneven. Some corners of the ecosystem have stalled, others have reinvented themselves, and a few are showing real traction. Understanding the state of blockchain means looking past price charts and into what’s being built, adopted, and institutionalized.

Beyond Speculation: Enter the Practical Phase

The first decade of blockchain was defined by speculation and the assumption that tokens were the product. The collapse of over-leveraged exchanges and synthetic yield schemes cleared out much of that noise, leaving a smaller but more durable community of actual builders. The industry now resembles the internet post–dot-com crash: the hype has receded and the underlying technology has matured.

The next phase will be driven by mainstream financial institutions and real-economy participants. Its success will not be measured by the market value of self-referential digital assets, but by the total value of real-world assets and real financial activity conducted on-chain.

In short: the blockchain’s relevance will depend on how much of the real economy it ultimately carries, rather than how efficiently it created closed token economies that primarily rewarded the people who built them. Most early blockchain promises won’t materialize, but the essential ones are taking root: faster settlement, portable identity, transparent digital ownership, and more programmable financial systems.

The Focus Has Shifted to “Real Problems, Real Customers”

Three types of blockchain applications that are gaining traction are:

Asset Tokenization and Settlement. The most tangible progress is in financial infrastructure. Tokenized money market funds, on-chain treasury operations, and real-time settlement rails are moving from pilots to production. BlackRock, JP Morgan, and Fidelity now participate in tokenized asset systems, a notable shift from five years ago when crypto was largely framed as anti-institutional.

Supply Chain and Provenance. Outside the spotlight, blockchain is being used to track pharmaceuticals across borders, authenticate luxury goods, and verify agricultural sustainability claims. Plus, there are also petroleum contracts on chain in the Gulf, and other use cases. The value here isn’t ideology. It’s auditability.

Identity and Ownership. A missing layer of the web has been digital identity. Self-sovereign identity frameworks are emerging to enable age verification without data leakage, credentials that move with individuals rather than platforms, and more portable attribution for work and creative output. If any part of Web3 endures, it will likely be this ownership layer of the internet.

What Has Faded

Not everything flourished:

Retail crypto speculation collapsed: The “buy because it’s going up” era is over; growth now requires real use cases.

Play-to-earn gaming fizzled: The economics depended on constant new players; when growth slowed, the model broke.

Most utility tokens lacked utility: Many tokens never powered real products or services, so their value couldn’t hold.

This is good. Bad ideas dying is part of healthy Darwinian progress.

The Technological Advances Are Real

Some of the quietest progress has been the most meaningful:

Zero-knowledge proofs now enable privacy without trust.

Layer-2 scaling now supports much higher transaction throughput.

Interoperability standards are emerging, making previously isolated blockchains talk to each other.

Software is getting better. More importantly, it is getting cheaper and easier to build with.

Regulation Is Becoming Clearer

Regulatory clarity has been painful, slow, and uneven. But it is becoming real.

Cryptocurrencies are increasingly being treated like commodities or securities, depending on function.

Stablecoins are moving toward bank-like regulation.

Digital asset custody and reporting standards are converging with traditional finance.

This is the moment where experimentation gives way to compliance and legitimacy.

The Next 5 Years

The winners in blockchain will be the ones solving practical problems, integrating with existing institutions, and prioritizing adoption and interoperability over ideology. Blockchain is no longer a revolt at the edges of the world’s financial system. It’s becoming part of the system. And that’s how transformative technology actually succeeds: not by overthrowing, but by quietly reshaping from within.

J’ai hâte de vous revoir lors de la prochaine Paris Blockchain Week, ou à Paris avec Dowsers.

We’re clearly entering a new era for blockchain. Glad to have you by our side to elevate smart contract security by making formal verification accessible, affordable, and scalable.

Hey, great read as always. Your analysis of blockchain's shift from speculation to practical infrastructure truely captures the current nuanced landscape. As this infrastructure matures, do you anticipate a natural convergence towards more centralized governance within these new ecosystems?