“The Magnificent Seven” And Other AI Investment Trends in 2023

A Reflection at the Half-Year Point

Thus far in 2023, investment trends in AI in public and private companies suggests that the technology is continuing to hold a fascination for investors who have a firm belief in its upside. The consensus, however, among public equity investors, VC and PE firms seems to be that we are in the early innings of the game and AI still must mature and expand into new areas and use cases. As AI becomes more widely adopted, investments in companies developing AI use cases and applications will become more mainstream in the years to come.

In the public company arena, there’s clarity with:

“The Magnificent Seven”: This phrase was coined by CNBC’s Jim Cramer to describe seven tech stocks – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Meta (META) and Nvidia (NVDA) and Tesla (TSLA) which have shown impressive growth and performance this year, due, in part, because they are perceived as focused on or fully AI-centric.

Additionally, firms like Adobe (ADBE) and human-resources leader Workday (WDAY) have deeply embedded AI and machine learning in their platforms and as a result benefit from the “halo effect” of AI in the public markets.

Startups will use AI extensively and that, in turn, will increase the probability and magnitude of investments and exits in the following eight areas:

Anti-Fraud and Security: The Internet provides the largest “attack surface” with multiple “vector points” for bad actors to ransom data and machines, set off various types of fraud, produce supply chain problems and infect email, networks and infrastructure with malware and viruses. As the bad actors escalate the use of AI, enterprises and software vendors will escalate the use of AI in order to prevent attacks, secure data and minimize damages.

Chatbots: VC funding AI-powered chatbots startups for businesses soared in recent years, coming in at just under $800M for both 2021 and 2022. However, funding is showing signs of slowing in 2023 amid the broader fall in venture activity, with just $215M going to the space so far. Two AI chatbot companies have raised funding in 2023 YTD — and both cater to the banking industry. Cross-functional chatbots – booking travel, restaurants, entertainment and other related functions in one bot-solution – are likely to be the first applications widely adopted by consumers.

Climate Change: AI can be used to address climate change in a variety of ways, such as developing renewable energy sources, optimizing transportation networks, and reducing energy consumption. As the world becomes more focused on addressing climate change, we can expect to see investments in AI addressing this field to increase significantly.

Enterprise Applications. AI is increasingly being used by enterprises to drive and expand operations and improve decision-making in areas such as customer service, fraud detection, and supply chain management. As AI becomes more accepted, with safeguards put into place, and larger language models (LLMs) established, investments will follow.

Ethics & Safety. To quote Winston Churchill, “with great power comes great responsibility.” The same will hold true for AI. Obvious needs for focus are in the areas of ethics and safety which should include guidelines around areas such as bias and discrimination. With those in place, the dollars will follow.

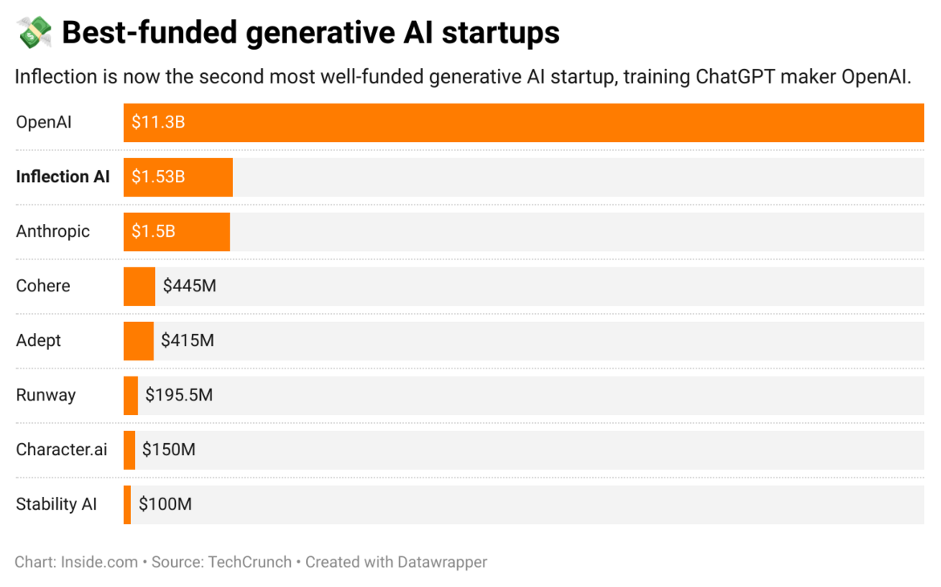

Generative AI: Expect increased investment in Generative AI (GAI). In contrast to traditional AI which is typically used to analyze existing data, GAI is used to create new data, such as images, text, and music. There are a wide variety of use cases and applications including journalism, financial analysis reports, generating marketing materials, writing creative content and creating the programming that leads to new software products and solutions.

The top ten largest among Generative AI startups financings are:

Healthcare: AI is already being used in healthcare to improve diagnosis, treatment, and patient care. For example, AI can be used to analyze medical and dental images, identify diseases, and recommend treatments. Clearly, this is only the beginning for applications of AI that will analyze or replicate the human body. It’s reasonable to expect to see even more investment in this area.

Tools: The picks and shovels of this AI gold rush include GitHub Copilot (automate code generation); Jasper (AI writing assistant); Lovo.ai (AI-based voice generator and text-to-speech platform); Murf (text speech generator); NVIDEA’s H100s and A100s (GPUs); Pictory (creating and editing video); Pinecone (vector database); Reply.io (all-in-one sales engagement platform); Tabnine (AI code completion tool) and Tideo (chatbot creator), and others.

Some VC and PE firms have come to the conclusion that this is best segment of the burgeoning but not-yet-mature AI industry to invest in at this time.

Companies like Amazon, Google, Microsoft, NVIDIA and other major tech companies will continue to make significant investments in AI R&D in order to remain at the forefront of advancing AI technologies. As AI becomes increasingly important and mainstream across industries, these companies will likely continue to invest in AI and expand their offerings. This is likely to involve acquiring specialized and differentiated tools, startups, or companies that have developed unique AI technologies or applications.

The AI ecosystem is constantly evolving with advances in chips, hardware, algorithms, dev tools and data management techniques. These advancements drive the need for ongoing investment in R&D to push the boundaries of what AI can achieve.

Overall, the strong investment trends in AI in the first half of 2023 reflect the growing recognition of AI's transformative potential. As the technology continues to mature, new use cases emerge, and AI becomes more integrated into various industries, we can anticipate even greater investment in AI in the years to come.