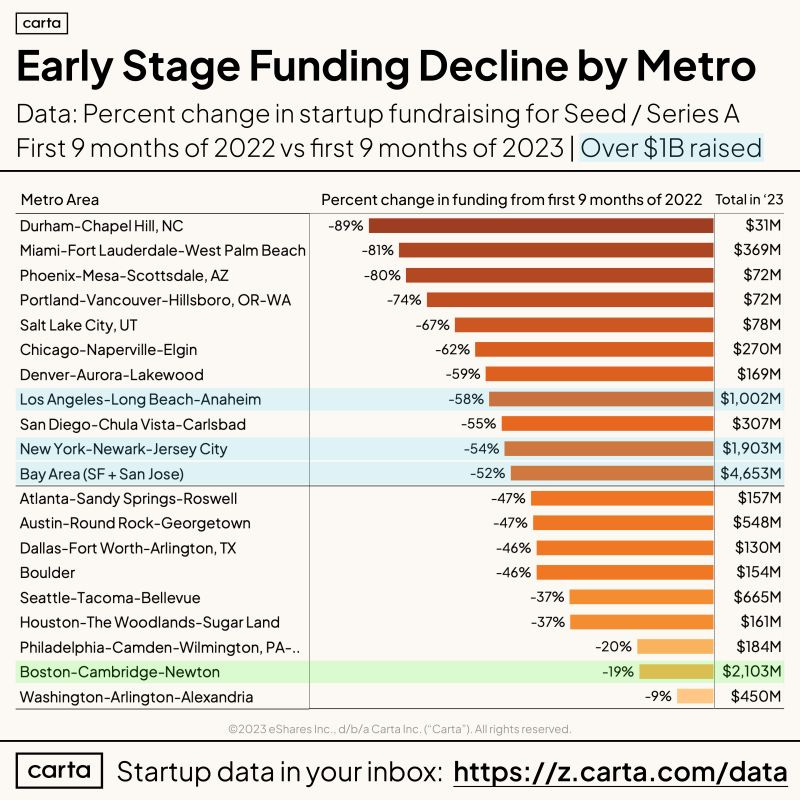

Just in case you missed this chart from CARTA in your LinkedIn news feed, here it is again:

The graph shows the percentage change in startup funding for seed/series A rounds in the first nine months of 2023 compared to the first nine months of 2022, for metro areas with over $1B raised.

Overall, the graph shows that startup funding is down across the board, but there are still some metro areas that are seeing significant investment. Based on this graph, all metro areas experienced a decline in funding, with Durham-Chapel Hill, NC experiencing the steepest decline at -89%, followed by Miami-Fort Lauderdale-West Palm Beach, FL at -81%, Phoenix-Mesa-Scottsdale, AZ at -80%, and Portland-Vancouver-Hillsboro, OR-WA at -74%. The San Francisco Bay Area experienced a decline of -55%. Note also declines in LA and the NY-metro.

Despite the overall decline in funding, several metro areas had substantial investment – in particular, the Boston-Cambridge-Newton, MA area.

There are a number of reasons for this decline in funding impacting angels, VCs, strategic and other investors:

LP’s decline in funding VCs due to poor performance results in an investment slowdown by VCs. This appears to most acute in the Silicon Valley.

Rising interest rates which makes it more expensive for startups to borrow money and bond’s having comparatively better – short term – yields.

The downturn in the stock market which has made investors more cautious about investing in risky assets like startups.

The reaction to inflated valuations and “easy money” during the 2020-21 timeframe alongside the downturn in M&A.

The ongoing war in Ukraine and recent Israel-Hamas confrontation.

Economic uncertainty leading to a soft landing? or recession? in the 1Q’24.

Founders and startup CEOs should be prepared to face a more challenging fundraising environment in the coming months, but there are still opportunities for well-positioned startups to raise capital.