Early Through Later-Stage and Public SaaS Valuations

This post serves is a continuation and further exploration of the topics discussed in the previous post (here) but focuses on SaaS valuations.

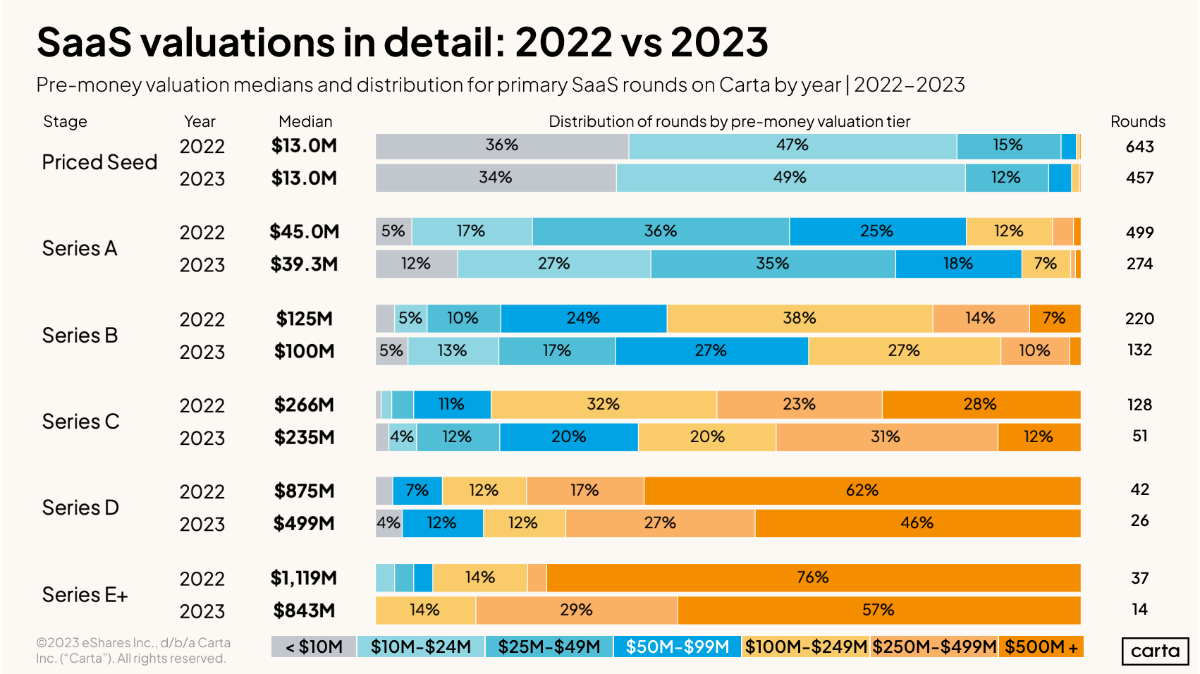

The startup world uses valuations as a crucial tool for finance, accounting, industry benchmarking, and exit activities. These valuations, influenced by various factors, including the economic climate, funding, market dynamics, financial health, competitive standing, and growth potential, define company worth limits. Excluding private company valuation methods (covered in earlier "Lessons" posts; here for one example), Carta – a cap table management and valuation SaaS – provides useful data. The graph that follows offers a comparative look at the median pre-money valuations and distributions for SaaS funding rounds in 2022 and 2023:

Early-Stage SaaS Valuations:

The median pre-money valuation for priced seed rounds remained steady at $13.0 million from 2022 to 2023, with minor distribution shifts, while Series A experienced a decrease in median valuation from $45.0 million to $39.3 million, along with an increase in the $25M-$49M valuation tier. Part of the reason for this is the value of public SaaS companies appreciated massively during COVID, peaking in late 2021 and then declined.

Regular "Lessons" readers will know that Series A valuations have dipped due to three factors: rising interest rates and macro-economic challenges, the end of the pandemic's economic boost (the "COVID sugar-high," as Alex Clayton calls it here), and escalating geopolitical tensions including the Israel-Gaza conflict, the Ukraine war, and issues like the China-Taiwan and Red Sea crises. However, this decline could be mitigated by the potential of AI in SaaS platforms, where enhanced efficiency, personalization, and predictive capabilities could significantly raise valuations by providing more advanced, tailored solutions to customers.

Later-Stage SaaS Valuations:

Series B through E+ rounds saw a decrease in median pre-money valuations between 2022 and 2023, with a notable shift towards lower valuation tiers, indicating a trend of market recalibration. Series B valuations decreased from $125 million to $100 million, Series C from $266 million to $235 million, Series D from $875 million to $499 million, and Series E+ from $1,119 million to $843 million, with valuations more evenly distributed across different tiers.

The number of rounds conducted at each stage also shifted, with priced seed rounds decreasing from 643 in 2022 to 457 in 2023 and Series E+ rounds dropping from 37 to 14. Series A and B rounds decreased in number, while Series C and D rounds increased.

Public SaaS Company Valuations:

In addition, analyzing public company data complements the picture by providing broader market context and benchmarks.

After a period of high valuation multiples during 2020-2021, driven partly by pandemic-induced digital transformation, the median revenue multiple for SaaS companies declined in early 2022. By the beginning of 2023, this multiple had decreased to 6.7 times revenue, but it rebounded slightly to around 7.8 times revenue by mid-2023. The decrease in valuation multiples was attributed to the three factors spelled out above, which particularly impacted unprofitable public SaaS companies.

SaaS Company M&A:

SaaS M&A activity remains robust, with deal volume on track to set a record level in 2023. There has been a focus on SaaS targets that offer mission-critical solutions to recession-resistant markets. Companies with low churn, capital efficiency, and mission-critical applications fared better in terms of enterprise valuation levels.

In Summary:

While public SaaS valuations encountered downward pressure in 2023, pre-public SaaS companies should focus on enhancing strengthening financials (especially margins), scaling, and strategic market positioning to attract venture capital and secure higher valuations in 2024.

Carta's data reveals declining valuations from Series A to E+ between 2022 and 2023, leading to increased investor due diligence; prolonging fundraising and demanding more stringent financials; market recalibration, likely reducing startup funding and impacting growth strategies; and a shift in funding allocation, possibly tightening the financial environment for SaaS companies and hastening their shift towards self-funding, profitability, and streamlined operations.

In the medium term (2024-25), pre-public SaaS companies, in response to these trends, may need to focus on higher ARR, extending their cash runway, and focusing more on unit economics and GTM efficiencies in order to navigate the investment climate.

Love your newsletters. They’re informative and quick to read!