Downturn Observed in VC Deals

The data in this post is taken from Cooley’s Q3 2022 Venture Financing Report but presented in tables with my commentary.

Cooley us a global law firm with nearly 1,500 lawyers across 18 offices in the United States, Asia and Europe, 385 partners and more than 3,000 people worldwide. Cooley is ranked as the #1 law firm in the US for overall venture deal count.

In Q3’22, the number of reportable VC deals and invested capital continued a downward trend and represented the lowest for both metrics since Q4 2019.

Cooley handled the following:

Comparing Q4’21 to Q3’22, the drop in the amount of funding raised by startups across stages is significant for later stages and less so for early stages:

These declines in amounts raised are consistent with trends seen in the broader market.

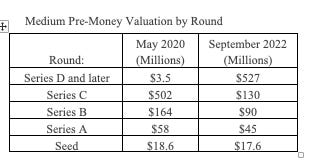

Median pre-money valuations reflected a similar trend with the decline in median pre-money valuation was significant in later stages and less significant for Series A and seed deals:

Cooley may not be getting the largest share of Seed and Series A deals, but these trends are still indicative. (Cooley, a very large firm, charges more than individual practices or small and medium-sized law firms.) Also, with respect to Series B-C-D deals, there are more funds raised to cover the costs of more expensive law firms and the deals are more complicated necessitating the experience of a larger law firm involvement.

This report therefore serves as a confirmation of what we know at the street level.

Looking forward, all indications are that these metrics (i.e., the number of VC deals, invested capital by VCs across stages, and pre-money valuations) unfortunately will decline further in the first half of 2023 and perhaps longer, and won’t recover until healthy M&A returns and the IPO pipe reopens.