Cloud Wars 2.0: How AI Is Redrawing the Cloud Services Market Map

The cloud services market continues to expand as market leaders like Amazon (AWS), Microsoft, Google Cloud, and Meta race to meet soaring AI demand. They’re not only scaling infrastructure but also accelerating innovation to power the next wave of digital transformation—positioning cloud as a strategic engine for long-term growth.

Key Insights

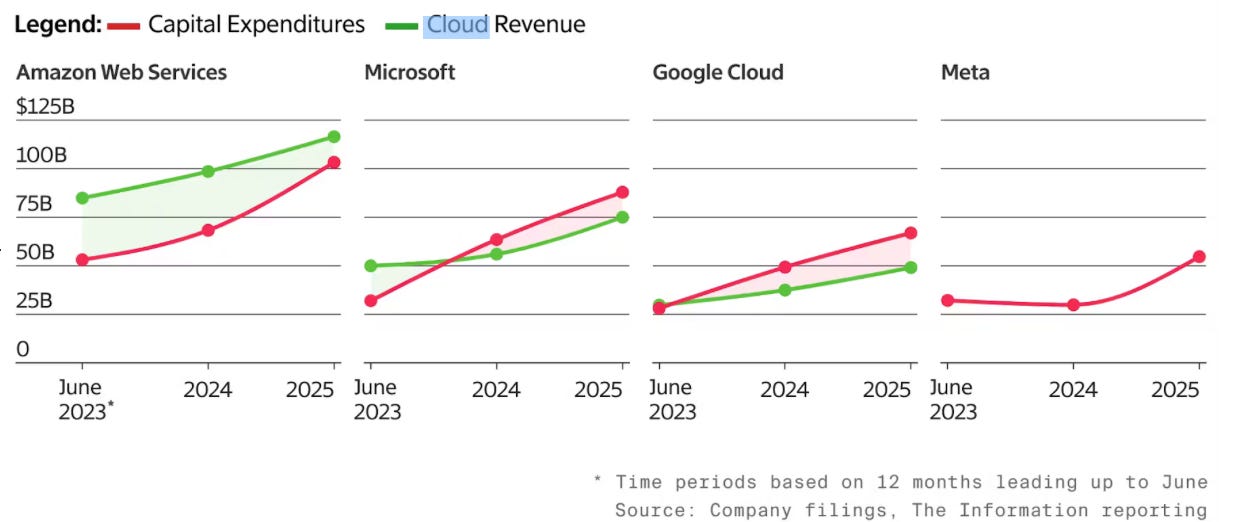

AWS remains the cloud revenue leader, but its margin is narrowing as Microsoft and Google grow at a faster pace, steadily closing the gap.

Microsoft and Google’s cloud investments are beginning to pay off, with capital expenditures overtaking or matching their cloud revenues by 2025—signaling that their aggressive spending on AI infrastructure is now translating into meaningful revenue growth.

Meta is investing heavily in cloud infrastructure, with rising capital expenditures but no corresponding cloud revenue, indicating a focus on internal AI and data center capabilities rather than public cloud offerings—at least for now.

In 2025, capital expenditures for Microsoft, Google, and Meta exceed their cloud revenues, highlighting continued infrastructure expansion likely aimed at supporting AI and compute-intensive workloads—an approach that contrasts with AWS, which still generates more revenue than it spends.

Strategic Implications

AWS may need to accelerate innovation or pricing strategies to maintain leadership as others gain momentum.

Microsoft and Google are positioned to capitalize on AI-driven demand with recent infrastructure investments.

Meta’s infrastructure buildup could foreshadow an eventual entrance into broader cloud or AI compute services (so-called AI as a Service, or AIAAS), or simply reflect internal AI ambitions (e.g., Llama and the Metaverse).

Conclusion

The cloud market is shifting as Microsoft and Google close in on AWS by aggressively investing in AI infrastructure, prioritizing long-term positioning over near-term profitability. Meta’s heavy Capex hints at ambitions in AI infrastructure or future AIAAS offerings, signaling that the next phase of cloud leadership may hinge on powering the AI-native economy.

This suggests the cloud market may ultimately split into two distinct strategies: AWS prioritizes profitability and scale, while Microsoft, Google, and potentially Meta are betting on AI as a transformative shift that warrants heavy upfront infrastructure investment. As generative AI adoption accelerates, the leading cloud providers may not be those with the largest market share today, but those best positioned to enable and monetize the next generation of AI-native applications.