Beyond the Hype: Candid Insights from Greg Clark and Alberto Yepez

A Fireside Chat with Two Silicon Valley Investors with Great Track Records

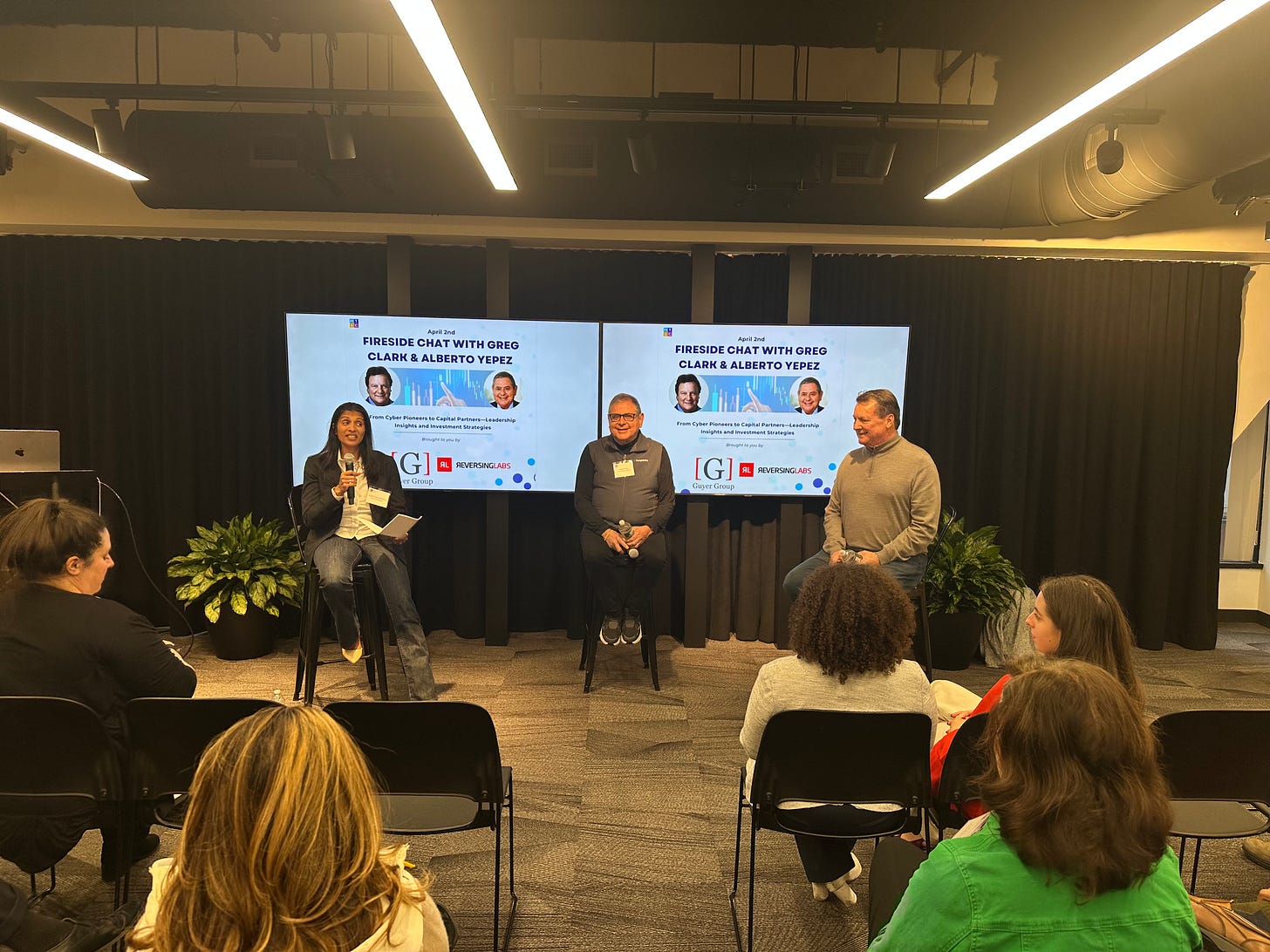

Last night at the CIC, Angela Singhal Whiteford, CMO of Corvus Insurance, moderated a fireside chat with Greg Clark, Co-founder and Managing Partner at Crosspoint Capital, and Alberto Yepez, Co-founder and Managing Director at ForgePoint Capital. The event was hosted and organized by the Guyer Group, ReversingLabs, and MTLC.

The conversation was wide-ranging—spanning market uncertainty, the realities of AI, shifting geopolitical tides, and what it takes to build enduring companies in today’s environment. Here are some of the most compelling takeaways, offering valuable perspective for founders, operators, and investors alike.

The Investment Landscape: Disruption Meets Discipline. Greg Clark opened with a clear message: the fundamentals of starting a great company haven’t changed. It still takes bold disruption, a compelling 10X value proposition, and unwavering conviction. “Without all three,” he warned, “don’t do it.” Or, more memorably: “Cash is like shoes—you don’t cross the desert without them.” Alberto Yepez expanded the view, noting we’re at the edge of a transformation potentially greater than the internet era. While AI is currently reshaping consumer experiences, the enterprise wave is coming—and it will require entirely new infrastructure, including scalable compute power and energy innovation.

Cut Through the AI Noise. As the discussion turned to artificial intelligence, both speakers cautioned against getting swept up in the hype. Greg suggested delaying major AI bets until the end of 2026 unless there’s a narrowly defined, high-impact use case. Alberto took a more hands-on approach, advocating for advisory councils made up of real users and close collaboration with enterprise partners. The message was clear: the next breakout AI company won’t be built on headlines—it will be built on execution.

Exits First: Build with the End in Mind. When it comes to investing, both panelists stressed the importance of long-term thinking. Alberto compared it to chess: success requires planning the exit from day one. That means building not just a product, but a buyable company through co-marketing, co-selling, and strategic alignment. Greg echoed this with his firm’s strategy at Crosspoint—targeting underperforming companies, applying seasoned operator insight, and scaling them with founder-level intensity. He sees unique opportunities in less saturated markets like Western Europe and Japan.

Thriving Through Uncertainty. The backdrop to all of this, of course, is a world in flux. Greg pointed to the impact of global instability: lower consumer confidence, tighter capital, and more selective hiring. But Alberto offered a more hopeful counterpoint, citing a recent cyber conference in Munich: “Innovation doesn’t stop during a crisis—it accelerates.” What’s needed now, they agreed, is a strong community built on trust, shared values, and aligned incentives among founders, investors, and acquirers.

What Stands Out: Usability Over Flash. Asked what makes a startup memorable, Greg highlighted those working on testing AI models and tracing errors—what he sees as the foundation for the next “Snowflake”-level company. Alberto, meanwhile, focuses on execution in underserved markets. His example: Huntress, a cybersecurity firm for SMBs. It’s not flashy, but it’s highly effective. The lesson? Success often comes down to simplicity, usability, and scale—not novelty.

Rethinking Cloud, Valuations, and AI. Greg challenged the assumption that cloud and AI are inherently linked. Due to rising cloud costs, he expects more companies to rethink their architecture. Many AI models, he argued, don’t require a SaaS layer—they can be trained once and reused. On valuations, he struck a note of caution: AI startups closing deals at $700M with no revenue are signs of a bubble that could surpass the dot-com era. His advice to fellow investors? Be patient, conserve cash, and stay disciplined.

Final Word: Stay Bold, Stay Grounded. Greg closed the night with a rare moment of vulnerability: “Maybe I’m wrong—but I don’t like what I’m seeing.” In an era where hype often drowns out reflection, his humility stood out. The takeaway? This isn’t a moment to fear missing out—it’s a time to stay focused, invest with clarity, and build quietly in the margins where lasting change begins.

What resonated most with you from Greg and Alberto’s insights? I’d love to hear how you're navigating this moment—whether you're building, investing, or somewhere in between.

If this sparked a thought—or a debate—consider sharing it with a colleague or fellow founder.

Very interesting thoughts, thanks