AI CapEx and the Race to Build the Future

The Financial Engine Behind AI: Understanding CapEx’s New Role

CapEx refers to cash spent to acquire or build long-term assets that deliver benefit over multiple years—such as servers, GPUs, data centers, IP, or capitalized software—rather than being expensed immediately. These investments are recorded on the balance sheet and amortized or depreciated over time, reducing current cash flow but impacting future earnings.

In AI or software businesses, CapEx ranges from cloud infrastructure and GPU clusters to patents and internal platform development, with asset-light SaaS models on one end and capital-intensive hardware or chip producers on the other. CapEx is central to assessing scalability, capital intensity, defensibility, and free cash flow, and is a key input for valuation, especially when separating growth CapEx from maintenance CapEx.

Two Graphs

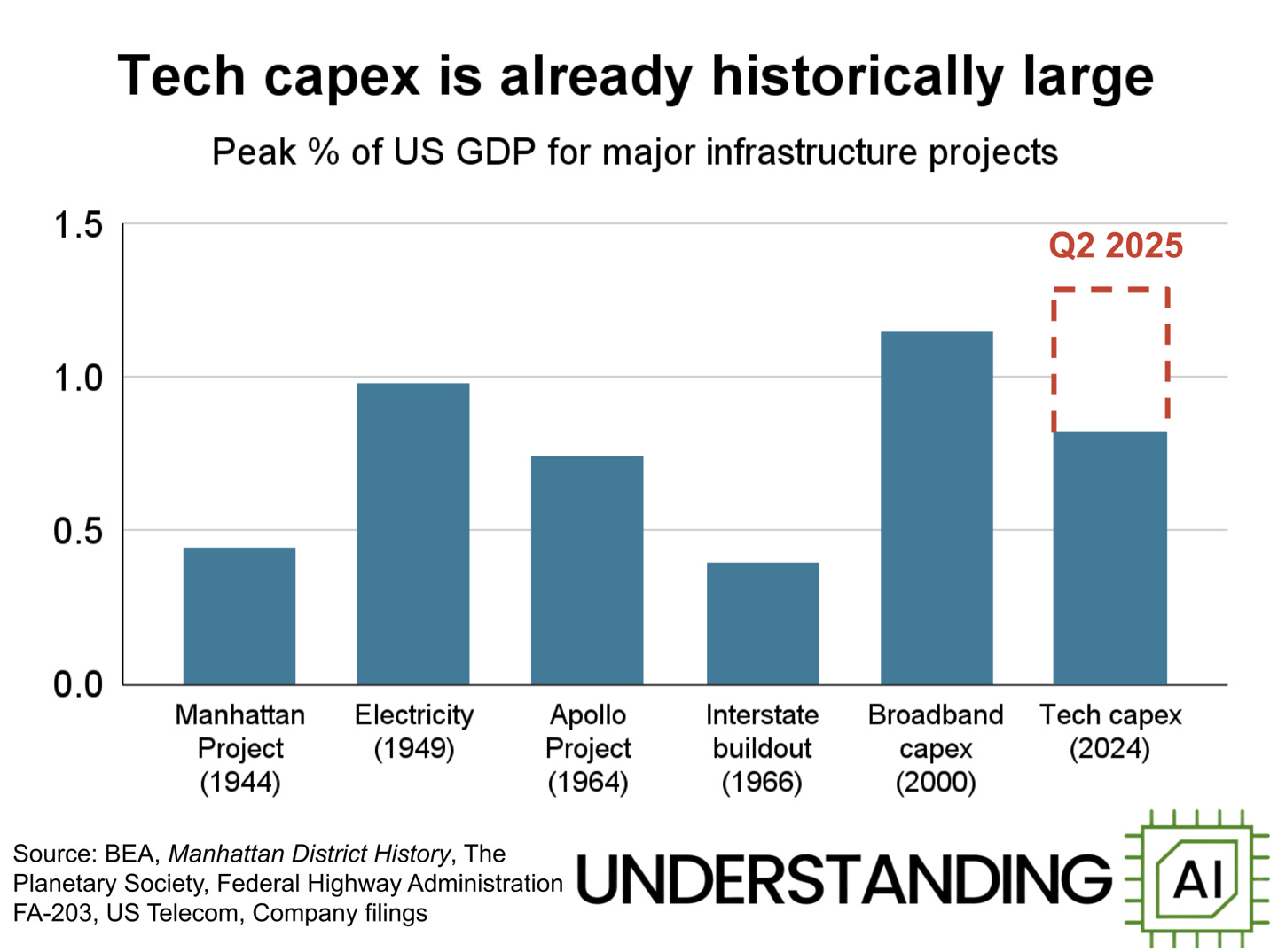

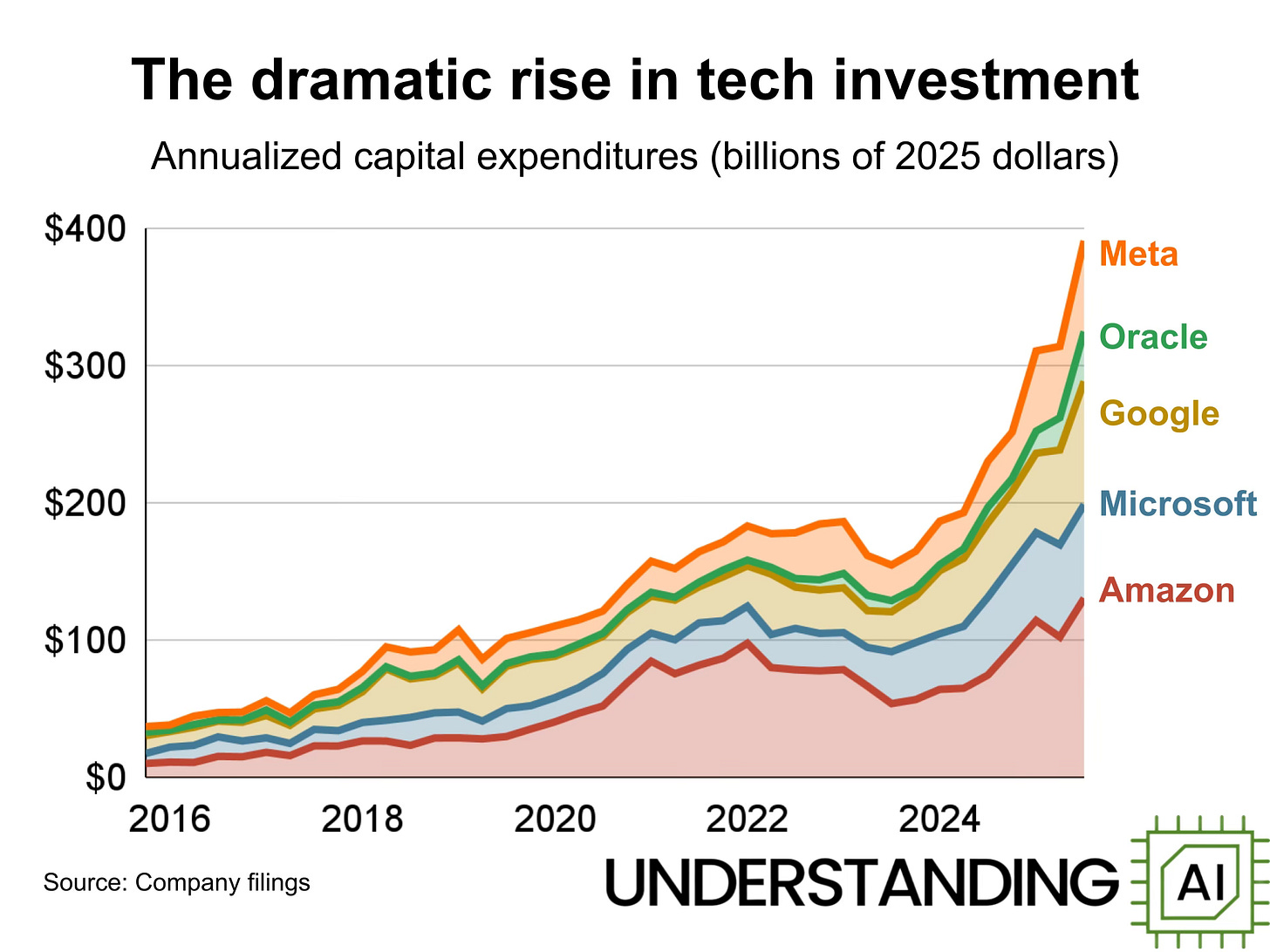

Here are two graphs (courtesy of Kai Williams, @chiwilliams) illustrating CapEx spending by leading tech companies—both in absolute terms and in historical context:

The first chart shows that tech capital spending in 2024 has exceeded 1% of U.S. GDP—putting it on par with historic national investments like the Manhattan Project, the Apollo Program, the interstate highway system, and the electricity grid. The Q2 2025 projection shows continued acceleration, underscoring that this is no longer a corporate spending cycle but a sustained, strategic, economy-shaping buildout of AI and digital infrastructure—comparable to the foundational technologies that defined entire eras.

The second chart reveals who is powering this surge: the tech giants—Meta, Google, Microsoft, Amazon, and Oracle. Their annual capital spending has exploded from about $50 billion in 2016 to nearly $400 billion projected for 2025—an eightfold jump, with the steepest acceleration after 2023. This isn’t just cloud expansion; it’s a full-scale buildout of compute, power, real estate, network, and GPU infrastructure at a scale once reserved for government-led national projects.

CapEx as the New Strategic Weapon

For companies building or enabling AI infrastructure, the data signals a profound transformation: CapEx is no longer just a cost to support operations; it has become a core strategic weapon. Capital intensity is now directly correlated with defensibility. Owning compute, energy, data, proprietary models, and physical infrastructure increasingly define who has leverage and competitive staying power. This type of CapEx is not merely sunk investment—it is monetizable, as seen in the rise of AI cloud services, inference capacity leasing, and API-based usage models.

Conclusion

Massive CapEx is not just fueling AI—it is literally building the infrastructure of the AI economy. Technology companies have assumed roles that historically belonged to governments, constructing essential platforms on which future innovation, automation, and intelligence will run. Large and small AI infrastructurecompanies are operating in the middle of this transformation, where CapEx determines capabilities, speed, pricing power, and long-term strategic control. Those who architect it, build it, and ultimately own it are defining today’s AI market—and designing the next platform era.

Doug, you present key insights about the potential power of CapEx determining strategic success in the provision of AI infrastructure. I'd like to see your take on reconciling this with your equally key insights about upcoming glut in AI infrastructure (your Nov. 9 post: "The Coming Compute Glut and What Happens After the Data Center Boom").